Micro-Finance

Microfinance, also called microcredit, is a type of banking service provided to low-income individuals or groups who otherwise would have no other access to financial services.

Despite being excluded from regular banking services, those who live on a few dollars a day do attempt to save, borrow, acquire credit or insurance, and reliably make payments on their debt.

Thus, many poor people must typically look for help with family, friends, or even loan sharks (who often charge exorbitant interest rates such as 10% per week).

A man named Muhammad Yunus from India, sought to resolve this issue, and found a different way of loaning money to low-income communities, thus micro-finance was born. This theory was so effective in empowering impoverished communities that Muhammad was awarded the Nobel Peace Prize.

Vicoba

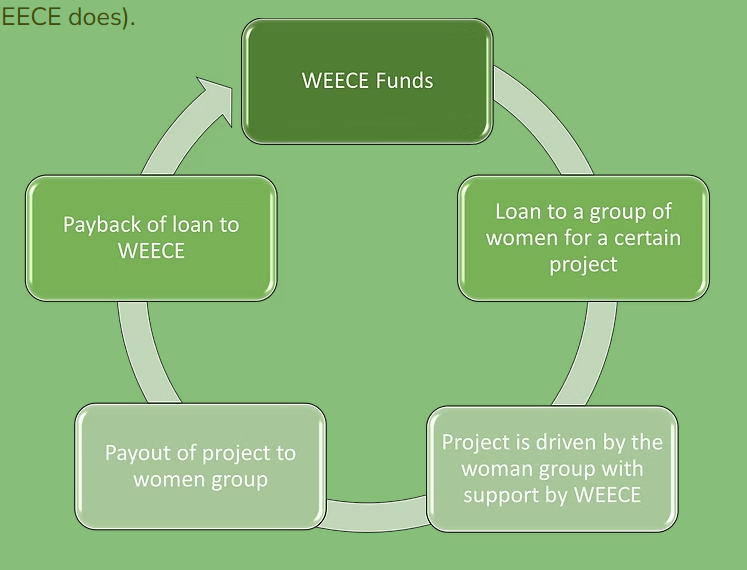

At WEECE, we believe in this theory. With microloans we can help disadvantaged women extract themselves from poverty. Unlike typical financing options, in which the lender (bank) is primarily concerned with securing his loans with sufficient collateral, we at WEECE rely on building communities in which social expectation guarantees every loan is paid back in time (these are also known as VICOBA groups, see the VICOBA tab for more detail on its structure).

However, we do not only offer financial support to these communities, unlike a bank or traditional micro-credit that often limits their contributions to financial transactions. At WEECE, we offer advice and counselling to help the VICOBA groups design the right projects for them (see the projects tab to see the work WEECE does).

Other Activities

Analysis of the general overview of the project

Contract signig and payout of the funds

Mentoring and consultance throughout the project